AI Business Plan Generator: Create a Professional Business Plan in Hours, Not Months

Here’s a common scenario that plays out with aspiring solopreneurs.

They’ve got a solid business idea. They know they need a business plan for funding, or just to clarify their thinking. So they download a template, open it up, and stare at 40 pages of blank sections asking questions they don’t know how to answer.

Three weeks later, they’ve written maybe 5 pages. The document sits in their drafts folder, mocking them. Meanwhile, competitors who didn’t overthink it are already in business, learning and adjusting as they go.

That’s the planning paralysis problem. Traditional business planning feels overwhelming because it is overwhelming when you’re doing everything yourself.

Here’s what shifted: an AI business plan generator can now create a solid first draft of your entire plan in 30-60 minutes. Not a perfect plan, but a complete framework you can customize based on your actual business.

We’re not talking about replacing your strategic thinking. We’re talking about eliminating the blank page problem and getting you a working document you can actually use.

In this guide, we’re breaking down why AI business planning tools matter, which ones deliver quality output, and how to create a plan that actually helps you build your business instead of just checking a box.

Before you build your plan, get the simple flow that turns your ideas into consistent client demand.

The Predictable Client Flow breaks down the 3-step framework for creating steady, repeatable client growth without overcomplicating your marketing.

👇 Enter your email below to get it instantly.

You’ll get the full framework in your inbox – clear, focused, and easy to follow.

Why AI Business Plan Generators Matter for Solopreneurs

Business plans serve different purposes. Sometimes you need one for funding. Sometimes you just need clarity on where you’re going. Either way, AI makes the process way less painful.

The Planning Paralysis Problem

What typically happens is this: Someone decides they need a business plan. They research the “right” format. They find templates with dozens of sections. They start writing and immediately get stuck on market sizing or financial projections.

The problem isn’t that business planning is useless. It’s that traditional approaches were designed for MBAs working in corporate strategy departments, not solopreneurs trying to get something off the ground.

You end up spending months perfecting a plan instead of testing your actual business in the market. That’s backwards.

Time Scarcity Reality

As a solopreneur, every hour matters. Spending 60-80 hours writing a business plan from scratch means 60-80 hours you’re not building products, talking to customers, or generating revenue.

The math:

- Traditional approach: 60-80 hours to create complete plan

- AI-assisted approach: 5-10 hours (generation + customization + validation)

- Time saved: 50-70 hours

That time savings alone justifies using AI tools. You get the clarity and documentation benefits without the opportunity cost.

Professional Presentation Needs

When you need a business plan for investors, banks, or SBA loans, it has to look professional. They expect specific sections, financial projections, and a level of polish that signals you’re serious.

Creating that professional presentation manually takes skills most solopreneurs don’t have. Formatting, financial modeling, market research compilation, it’s a whole skillset.

AI tools generate plans that meet professional standards. The structure is right. The language is appropriate. The format looks credible. You customize the content, but the foundation is solid.

If this is giving you momentum, this flow shows you how to turn that clarity into steady client growth.

You can see the steps here → Get The Predictable Client Flow Framework

When You Actually Need Formal Plans

Not every business needs a formal written plan. But you definitely need one when:

Seeking funding:

- Bank loans require detailed plans

- SBA loans have specific documentation requirements

- Angel investors want to see your strategy

- Grants need formal applications

Strategic clarity:

- You’re launching something complex

- You need to coordinate with partners

- You’re making big financial commitments

- You want documented direction to refer back to

Business transitions:

- Selling your business

- Bringing on partners

- Applying for franchises

- Major pivots or expansions

If you don’t need funding and your business model is straightforward, you might not need a full formal plan. A one-page strategy document could be enough.

The Confidence Factor

Even if you don’t technically need a business plan, going through the planning process builds confidence. You’re forced to think through questions like:

- Who exactly is my customer?

- How will I actually reach them?

- What are my real costs?

- When will I break even?

Having thought through these questions makes you better prepared to execute. The plan itself might sit in a drawer, but the clarity you gained creating it guides your decisions.

Best AI Business Plan Generator Tools

Let’s talk about tools that actually create usable business plans, not just generic templates.

ChatGPT for Business Planning (Free to $20/month)

ChatGPT is the most flexible option. You can build an entire business plan through conversation.

How to use it: Start with: “I’m creating a business plan for [your business concept] targeting [your market]. Help me create a complete plan including executive summary, market analysis, competitive analysis, marketing strategy, operations, and financial projections.”

It generates section by section. You provide details, it structures them professionally. You end up with a complete draft customized to your actual business.

Best for: Solopreneurs who want control and don’t mind prompt engineering. Free version works fine for most planning needs.

Upmetrics ($7/month, annual plan)

Upmetrics is specifically built for business planning. It includes AI assistance plus financial projection tools.

What you get:

- AI-powered plan generation

- Financial forecasting templates

- Industry-specific examples

- Step-by-step guidance

- Professional formatting

Worth it if: You need financial projections and prefer structured software over ChatGPT conversations. The financial tools alone justify the cost if you’re seeking funding.

LivePlan ($20/month)

LivePlan is established business planning software that added AI features. It’s more traditional but solid.

Key features:

- AI writing assistance for each section

- Benchmarking data from real businesses

- Automated financial calculations

- Pitch deck creation

- Lender-ready formatting

Best for: People who want traditional business planning software enhanced with AI, not pure AI generation. More guided, less flexible than ChatGPT.

Enloop (Free to $20/month)

Enloop automates both plan writing and financial forecasting. You input basic info, it generates a complete plan with financial statements.

What makes it useful:

- Automatic text generation based on your inputs

- Financial sync (numbers stay consistent across sections)

- Performance scoring (tells you how strong your plan is)

- Multiple plan versions for different audiences

Free tier gets you basic plan generation. Paid tiers add financial forecasting and unlimited plans.

Understanding What Makes a Strong Business Plan

Before generating a plan with AI, you gotta understand what actually needs to be in there.

Executive Summary Importance

This one-page overview determines whether anyone reads the rest of your plan. Investors, lenders, partners, they all read the executive summary first. If it doesn’t grab them, they stop.

What it must include:

- Business concept (what you do, in one clear sentence)

- Problem you’re solving

- Your solution

- Target market size

- Competitive advantage

- Business model (how you make money)

- Financial highlights (key projections)

- Funding ask (if applicable)

Write this section last, even though it appears first. You can’t summarize a plan you haven’t written yet.

Market Analysis Requirements

You need to prove you understand your market. This means actual data, not guesses.

Key components:

- Industry overview (size, growth trends, major players)

- Target customer profile (specific demographics and behaviors)

- Market size (TAM, SAM, SOM if you’re seeking investment)

- Market trends (what’s changing, what creates opportunity)

- Regulatory factors (any legal requirements or restrictions)

AI tools can help gather this data, but you need to verify it. Don’t just accept AI’s market size numbers without checking sources.

Competitive Positioning

Every business has competition. Claiming you don’t just shows you haven’t researched properly.

What to cover:

- Direct competitors (businesses doing essentially what you do)

- Indirect competitors (alternative solutions to the same problem)

- Your differentiation (specific reasons customers will choose you)

- Barriers to entry (what makes it hard for others to copy you)

- Competitive response (how you’ll react when competitors adjust)

Be honest about competitive threats. Investors and lenders respect realistic assessment over wishful thinking.

Financial Projections

This is usually the hardest part. You need realistic numbers that show the business can work financially.

Minimum requirements:

- Revenue projections (3-5 years)

- Expense budget (detailed for year 1, category-level for years 2-5)

- Cash flow projections (monthly for year 1, quarterly after)

- Break-even analysis (when you become profitable)

- Funding requirements (if seeking capital)

AI tools can help structure these, but you need to provide realistic assumptions. Revenue doesn’t magically grow 500% year over year without explanation.

Creating Business Plans for Different Purposes

Different audiences care about different things. Your plan should emphasize what matters to your specific reader.

Investor Pitch Plans

Investors want to see growth potential and return on investment.

What they care about:

- Market size (is this big enough to matter?)

- Growth potential (can this scale?)

- Competitive advantage (can you defend market position?)

- Team (can you execute?)

- Exit strategy (how do they get their money back with profit?)

What to emphasize:

- Revenue growth projections

- Market opportunity size

- Scalability of business model

- Defensible competitive advantages

What to downplay:

- Conservative, slow-growth scenarios

- Lifestyle business framing

- Limited market size

Bank Loan Applications

Banks want to see stability and repayment ability.

What they care about:

- Collateral (what secures the loan)

- Cash flow (can you make payments)

- Experience (do you know this business)

- Personal financial strength (your credit and assets)

What to emphasize:

- Steady, reliable revenue projections

- Detailed expense control

- Collateral available

- Industry experience

- Conservative growth assumptions

What to downplay:

- High-risk growth plays

- Unproven business models

- Plans requiring additional future funding

SBA Loan Requirements

Small Business Administration loans have specific documentation needs.

Required elements:

- Personal background and experience

- Business description and history

- Market analysis and competition

- Management and organization

- Financial projections (3 years minimum)

- Loan request and use of funds

- Personal financial statement

SBA lenders follow specific formats. Using AI tools that understand SBA requirements saves time and reduces rejection risk.

Strategic Planning Documents

Sometimes you’re creating a plan for yourself, not external audiences.

Internal planning focus:

- Clarity on business direction

- Milestone and goal setting

- Resource allocation decisions

- Strategic priorities

- Quarterly or annual objectives

These plans can be less formal. You’re not impressing anyone. You’re thinking through your business systematically.

Generating Executive Summaries with AI

The executive summary is your business plan’s most important section. Here’s how to create one that actually works.

Hook and Vision

Open with your compelling business concept in one or two sentences.

Weak: “We are a technology company focused on innovative solutions.” Strong: “We help small restaurants increase takeout orders by 40% through automated SMS marketing that customers actually respond to.”

The strong version tells you exactly what the business does, who it serves, and what result it delivers.

Problem and Solution

Clearly state the problem you’re solving and how you solve it.

Framework:

- Problem: [specific pain point your customers experience]

- Solution: [how your product/service addresses it]

- Why now: [what makes this the right time for your solution]

AI prompt: “Write a problem-solution section for my business plan. Problem: [describe]. Solution: [describe]. Keep it to 3-4 sentences.”

Market Opportunity

Quantify the market size to show meaningful opportunity.

What to include:

- Total market size (if relevant)

- Your specific target segment size

- Growth trends

- Why this market is attractive

Example: “The U.S. restaurant technology market is $16B and growing 12% annually. Our target segment, independent restaurants with 1-3 locations, represents $4B of that market and is underserved by existing solutions.”

Financial Highlights

Share key numbers that show business viability.

Typical highlights:

- Year 1 revenue projection

- Year 3 revenue projection

- Break-even timeline

- Gross margins

- Customer acquisition cost vs. lifetime value

Keep it high-level. Detailed financials go in their own section.

Market Analysis and Research with AI

AI tools can compile research that would take weeks manually. But you gotta validate what they generate.

Industry Overview Generation

AI can create solid industry overviews pulling from multiple sources.

Prompt that works: “Create an industry overview for [your industry]. Include market size, major players, recent trends, and growth projections. Cite sources where possible.”

What to verify:

- Market size numbers (check against actual reports)

- Growth rates (confirm they’re current, not outdated)

- Major players (make sure list is complete and accurate)

- Trends (validate these are real, not AI hallucinations)

Target Customer Definition

AI helps structure detailed customer profiles, but you provide the actual insights.

Framework AI can help with:

- Demographics (age, income, location, education)

- Psychographics (values, interests, lifestyle)

- Behaviors (how they shop, what they value)

- Pain points (problems they’re trying to solve)

- Purchase triggers (what makes them buy)

Your input: Real information from customer interviews, surveys, or your own market experience. AI structures it professionally, but the substance comes from actual research.

SWOT Analysis Creation

AI generates decent SWOT analyses, but they’re generic without your specific input.

How to use AI for SWOT:

- Describe your business and market situation

- Ask AI to generate initial SWOT

- Review and replace generic items with specific realities

- Add items AI couldn’t know about your unique situation

Example of generic vs. specific:

- Generic Strength: “Strong customer service”

- Specific Strength: “24-hour response time vs. 3-day industry average”

The specific version is way more credible.

Financial Projections with AI Assistance

This is where most solopreneurs get stuck. AI helps but doesn’t eliminate the need for realistic assumptions.

Revenue Forecasting

You need to explain how you’ll generate sales, not just pick optimistic numbers.

Building realistic projections:

- Define your customer acquisition channels

- Estimate realistic conversion rates per channel

- Calculate average order value or contract size

- Project customer growth month by month

- Show your math and assumptions

AI can help: Structure the model, calculate totals, format tables. You must provide: Realistic acquisition numbers, pricing, conversion rates.

Red flag projection: “We’ll get 1% of a billion-dollar market in year one.” That’s 10 million dollars. How specifically will you acquire enough customers to hit that number?

Expense Budgeting

List every category of spending you’ll have.

Common expense categories:

- Cost of goods sold or service delivery

- Marketing and advertising

- Software and tools

- Rent and utilities

- Insurance

- Professional services (lawyer, accountant)

- Salaries (including your own)

- Taxes

AI prompt: “Create a detailed expense budget for [your business type] in year one. Include all typical categories and estimate monthly amounts.”

Review and adjust based on actual quotes or research. AI gives you the structure, but you verify the numbers make sense for your specific situation.

Cash Flow Projections

This is different from profit. You need to understand when money actually comes in versus when bills are due.

Why this matters: You might be profitable on paper but run out of cash because:

- Customers pay you in 30-60 days

- You have to pay suppliers immediately

- You have big upfront expenses before revenue starts

What to include:

- Starting cash balance

- Monthly revenue (when collected, not just invoiced)

- Monthly expenses (when paid)

- Ending cash balance each month

AI tools can calculate this once you provide timing assumptions. The key is being realistic about payment timing.

Break-Even Analysis

When does your business become profitable? This number matters for planning and credibility.

What you need:

- Fixed costs (rent, insurance, base salaries)

- Variable costs per unit or customer

- Average revenue per unit or customer

- Break-even calculation (fixed costs ÷ contribution margin)

Example: “With fixed costs of $5,000/month and contribution margin of $50 per customer, we break even at 100 customers. Based on our acquisition projections, we reach break-even in month 8.”

That’s specific and believable. “We’ll be profitable immediately” usually isn’t.

Customizing AI-Generated Business Plans

AI gives you a solid draft. Now you gotta make it yours.

Industry-Specific Adjustments

AI generates generic plans. You need to add industry-specific details.

What to customize:

- Industry terminology (use language your market uses)

- Specific regulations or certifications required

- Industry-standard metrics and benchmarks

- Unique challenges in your sector

- Key success factors specific to your industry

Example: A restaurant plan should mention health department permits, food cost percentages, and table turn rates. AI might miss these specifics unless prompted.

Personal Story Integration

Your background and why you’re doing this business matters, especially for funding.

What to add:

- Relevant experience or expertise

- Why you started this business

- What makes you qualified to execute

- Lessons from previous ventures

- Unique insights or connections

This is where using an AI business plan generator needs human input most significantly because your personal story and specific experience can’t be generated by any tool.

Data Validation

Don’t trust AI-generated numbers without verification.

What to check:

- Market size claims (find actual sources)

- Industry statistics (verify they’re current)

- Competitor information (confirm it’s accurate)

- Financial benchmarks (check against real data)

- Regulatory requirements (verify with official sources)

AI hallucinates. It generates plausible-sounding facts that are completely wrong. Your job is to catch these before they end up in a plan you submit to a bank or investor.

Voice and Tone Refinement

AI often writes in formal, corporate language. Make it sound like you.

Before (AI default): “Our organization leverages innovative methodologies to facilitate optimal customer outcomes through strategic implementation of cutting-edge solutions.”

After (human): “We help customers solve their biggest problems using proven methods and modern tools that actually work.”

Read the plan out loud. If it doesn’t sound like something you’d say, rewrite it.

Common Business Plan Mistakes to Avoid

Here’s what typically goes wrong with business plans, whether AI-generated or manual.

Unrealistic Projections

The classic mistake: Hockey stick growth with no explanation.

Red flag pattern:

- Year 1: $50k revenue

- Year 2: $500k revenue (10x growth)

- Year 3: $2M revenue (4x growth)

- No explanation of how you’ll achieve this

Better approach:

- Show specific customer acquisition plans

- Break down growth by channel

- Explain assumptions clearly

- Include conservative and aggressive scenarios

Investors and lenders have seen thousands of projections. Unrealistic ones destroy credibility instantly.

Market Size Exaggeration

“Our total addressable market is $500 billion” sounds impressive but meaningless.

The problem: You’re not going after the entire market. You’re targeting a specific segment with specific characteristics.

Better approach:

- Total addressable market (how big is the whole thing)

- Serviceable available market (who could use your solution)

- Serviceable obtainable market (who you can realistically reach)

Then show realistic penetration. “We aim to capture 0.5% of our serviceable obtainable market in year three” is way more credible than “we’ll get 1% of the total market.”

Competition Dismissal

“We have no competition” or “we’re completely different from everyone else” raises red flags.

Reality: If there’s a market, there’s competition. Either direct (other businesses doing what you do) or indirect (alternative ways customers solve the problem).

Better approach:

- Acknowledge direct competitors honestly

- Explain indirect competition

- Show your specific differentiation

- Explain why customers will choose you

- Address how you’ll respond to competitive threats

Sophisticated readers respect honest competitive assessment.

Vague Strategy

“We’ll use social media marketing” isn’t a strategy. It’s a platitude.

What’s missing:

- Which specific platforms

- What type of content

- How often you’ll post

- Expected reach and engagement

- Cost per acquisition targets

- Timeline and milestones

Better: “We’ll launch with Instagram focused on [specific content type] posted [specific frequency]. Based on similar businesses, we expect [specific engagement rate] leading to [specific acquisition cost]. Budget: [specific amount] for first 90 days.”

Specific beats vague every time.

Inconsistency Across Sections

Your market analysis says the industry is growing 15% annually, but your revenue projections show 200% growth. That doesn’t match.

Common inconsistencies:

- Market size doesn’t support revenue projections

- Team section doesn’t mention skills needed for strategy

- Financial projections don’t align with operational plans

- Marketing spend doesn’t match customer acquisition claims

Read your complete plan looking for contradictions. Fix them before anyone else spots them.

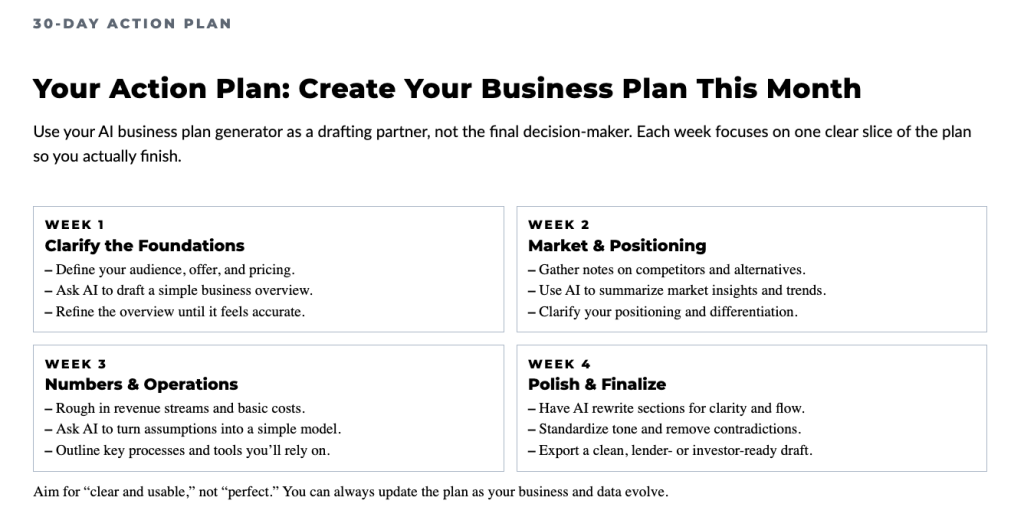

Your Action Plan: Create Your Business Plan This Month

You’ve got the framework. Now let’s actually build your plan.

Week 1: Foundation and Research

- Choose your AI tool (ChatGPT free works fine to start)

- Gather basic info: business concept, target market, competition

- Research market size and industry data

- Collect any financial information you have

- Total time: 4-6 hours

Week 2: Draft Generation and Customization

- Generate complete first draft using AI

- Review each section for accuracy

- Add your personal story and specific details

- Customize industry-specific elements

- Total time: 6-8 hours

Week 3: Financial Projections and Validation

- Build detailed financial projections

- Verify all AI-generated data and claims

- Check for internal consistency

- Get feedback from mentor or advisor

- Total time: 6-8 hours

Week 4: Refinement and Finalization

- Rewrite in your authentic voice

- Add any missing details

- Format professionally

- Create executive summary (write this last)

- Proofread everything

- Total time: 4-6 hours

Total investment: 20-28 hours for a complete, professional business plan

The Plan That Matters Most Right Now

What’s the actual purpose of your business plan?

Not “because I should have one.” The specific reason you need this document right now.

Maybe it’s:

- Bank loan application due in 6 weeks

- Investor pitch next month

- Partnership proposal you’re putting together

- Personal clarity on where you’re going

That purpose determines what you emphasize. A bank loan application looks different from an investor pitch. Know your audience, then customize accordingly.

Remember This

A business plan is a tool, not the business itself. The best plan in the world doesn’t matter if you never execute.

AI tools make planning faster and easier, but they don’t eliminate the need for strategic thinking and realistic assessment. You still gotta understand your market, know your numbers, and have a viable path to customers.

The solopreneurs who succeed aren’t the ones with the most perfect plans. They’re the ones who plan enough to build confidence and clarity, then go execute while adjusting based on reality.

Don’t let planning become procrastination. Use AI to create a solid plan quickly, then get out there and test your business in the real market.

As you move from planning into execution, use this simple flow to create consistent client demand.

The Predictable Client Flow breaks down the 3-step framework for creating steady, repeatable client growth without overcomplicating your marketing.

👇 Enter your email below to get it instantly.

You’ll get the full framework in your inbox – clear, focused, and easy to follow.

Here’s My Question For You:

What’s the one section of your business plan you’re most uncertain about right now?

Not the whole plan. Just one section.

Use the tools and frameworks in this guide to create that one section this week. Maybe it’s your market analysis. Maybe it’s your financial projections. Maybe it’s clearly stating your competitive advantage.

Do that one section well. Then tackle the next one. That’s how you build a complete plan without getting overwhelmed.

Perfect plans don’t exist. But clear, thoughtful plans that help you build your business with confidence? Those are absolutely achievable.

Your future self (the one running a successful business that started with a solid plan) is gonna thank you for doing this work today.

Now go build your plan and launch your business.